As written by Sandy Franks of thewomensfinancialalliance.com

The U.S. dollar (USD) has been the world’s global reserve currency for over 70 years. It was given this elite status at the Bretton Woods Conference in 1944; otherwise known as the United Nations Monetary and Financial Conference.

At this conference 44 nations gathered together from July 1 to 22 in Bretton Woods New Hampshire. Their goal was to agree upon new rules for the post-WWII global monetary system.

The amount of debt England incurred during the war forced it to pass the global reserve currency status over to the United States

Why does having this status matter?

Being given this status allows a currency to be worth much, much more than any other country’s currency. A large part of having a global reserve currency is your currency becomes global in demand.

It is the international baseline currency for all trade. Countries are agreeing, in principle, to trade with your currency. Currently about 20 currencies peg their currencies to the dollar. Doing so, gives other countries a powerful medium of exchange.

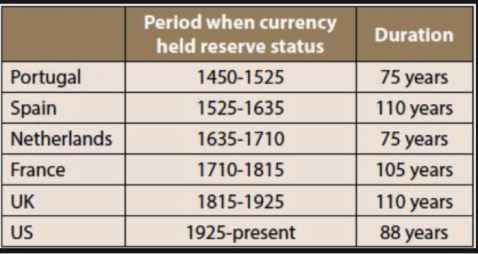

Six Latest Reserve Currency Countries

However, many countries, especially in East Asia, have stopped using the U.S. dollar for trading purposes.

Instead they are using “bilateral trade agreements” and they’re becoming popular these days. That’s prompted rumors that the U.S. dollar’s rein as “supreme currency” could soon come to an end.

Is this possible? Minneapolis Federal Reserve President Neel Kashkari said it’s possible the dollar could loose its status as the world’s reserve currency during his lifetime.

Let’s explore some of the challenges the U.S. faces in retaining this title.

Debt: Everyone knows that the U.S. has a debt problem. In fact, we’ve always had debt. In 1860, America’s debt was $65 million. The Civil War brought about a major spike in the debt. World War I and World War II also brought about major rises in the debt.

Although the amount has fluctuated, in recent years it has skyrocketed. We are now swimming in $19 trillion in national debt.

The U.S. owes almost US $3 trillion to just Japan and China alone. And regardless of whether Trump or Clinton wins the next election, the debt will only continue to grow.

Value of the Dollar: The value of the U.S. dollar has been in a downtrend for the last 31 years. The U.S. dollar index, which compares the greenback to the euro, yen, pound sterling, krona, franc, and Canadian dollar, has been trending lower since 1985.

Only over the past two years has the U.S. dollar increased in value relative to other major currencies. That’s not because the U.S. economy is doing so well; it’s that the other economies are doing worse.

Too Many Dollars: Another problem facing the U.S. dollar is that there is too much of it in circulation. The money supply started to increase in 1984; at the same time the value of the U.S. dollar started to decline against other world currencies.

To stimulate the economy following the Credit Crisis of 2008, the Federal Reserve announced three rounds of Quantitative Easing, a monetary policy that created trillions of dollars in new paper money.

Throughout history, countries that have continued printing more of their money eventually saw the value of that money collapse.

Negative Trade Balance: The U.S. has not had a positive balance of trade (exports minus imports) since 1976. That means since 1976 other countries have been exporting goods and services to us and we have been exporting our currency to them in return.

So if countries decided against the U.S. dollar as the reserve currency, what would they use instead?

Central bankers throughout the world, from Canada to Ireland, have recently suggested that they might issue a digital currency in the future.

There’s also the possibility of using the Chinese Yuan, also known as the Renminbi as the worlds’ reserve currency. Countries are trading so much Yuan that it has become the second most used currency in the world, passing the EURO in 2013.

If the USD is replaced, what happens to the U.S. economy? Without demand for the dollar, the end result would be a major currency devaluation and probably a drastic standard of living adjustment.

Could this actually happen? Anything is possible. These rumors have been around for a while but in recent years, they are getting louder and louder.

I hope the above forex currency trading information was of help to you.

Anthony at TradeCurrencyNow,

America’s Forex News and Currency Information source.

The above information is opinion based except where noted. Always contact a licensed professional for information on the above subject or BEFORE applying or practicing the above information.