Two Major Determinators for the Dow Jones Industrial Average Price Fluctuations

1) Dow Jones Industrial Average versus Inflation

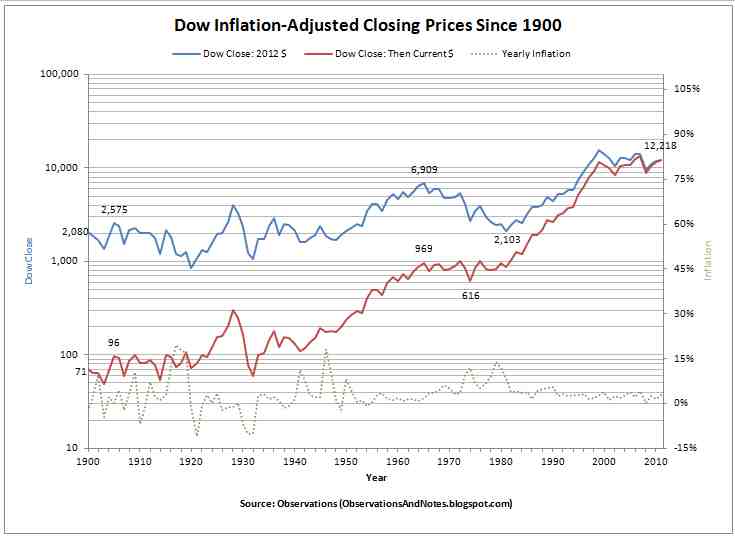

In the old days some people believed the Dow Jones Industrial Average over the long term is directly related to the USA inflation rate and the DJIA would return 1 to 2 percent above the average rate of inflation over the long term.

Let’s take a look at the United States Inflation Rate versus the Dow Jones Industrial Average Index Price.

The Dow Jones Industrial Average:

The DJIA in May 26, 2023 was 33,093.34

The DJIA in December 30, 1960 was 615.89

Over that 63 year period the DJIA rose 32,477.45 That is a 515.52 point average yearly increase of 6,470.0 % or a 8.3% yearly average increase.

NOTE: About 66% of the increase has happened since 2009 low, of 6,547.05, or over the last 24 years of heavy dollar printing or massive FED quantitative Currency Injections.

The USA Inflation Rate:

During the observation period from 1960 into 2023 the average inflation rate was 3.8% per year. Overall, the price increase was 903.96%. An item that cost 100 dollars in 1960 costs 1,003.96 dollars at the beginning of 2023.

What do the above numbers mean for DJIA and inflation; three possible scenario’s may play out: 1) much more inflation is required to support the current Dow Jones Industrial Average OR 2) the Dow Jones Industrial Average needs to drop considerably or 3) a combination of the two.

DJIA and Inflation Chart

Inflation Adjusted Dow Jones Industrial Average Charts click here.

More about the Dow Jones Industrial Average and how it relates to inflation and other measures click here.

2) The Dow Jones Average Portfolio Index Company Stock Replacements and Additions

I look at the Dow Jones Average as more of a Team Index than a Solid Index. What’s the difference; a solid index is an index that the components do not change unless the index is forced to change due to strictly outside forces, a team index is much like a baseball team where the players or company stocks change out. Where the Dow Indexes are concerned the components or stocks may and will change out at the will of the index management or by the indexes’ own rules or definitions.

For example the DJIA covers 30 ‘large cap companies”, which are subject to a criteria and picked by the editors of The Wall Street Journal.

Over the years the companies in the index have been changed to ensure the index stays relatively current in its measure of the U.S. economy.

Charles Dow first published the Dow Jones Industrial Average on May 26, 1896. On this day, the Dow consisted of only 12 companies. Of special note; only one of the initial companies included in the average remain – yes, you read that correctly. Currently, General Electric holds the longest listed Dow Jones Industrial Average Index / DJIA Company.

One can easily see that if the original 12 companies were still in the Dow Jones Industrial Average Index / DJIA today the index would be worth practically zero!!!

The original Dow Jones Industrial Average Index 12 companies:

American Cotton Oil

American Sugar

American Tobacco

Chicago Gas

Distilling & Cattle Feeding

General Electric

Laclede Gas

National Lead

North American

Tennessee Coal and Iron

U.S. Leather

U.S. Rubber

Therefore; changing out the companies does have a direct reflect on the Dow Jones Industrial Average price.

This is why a person who trades Dow Jones Industrial Average 30 as a group may need to be aware of the above company stock change outs or added companies to the Dow Jones Industrial Average.

NOTE: On August 24, 2020, three companies were replaced on the Dow Jones Industrial Average Index / DJIA, the companies Salesforce, Amgen and Honeywell were added to the Dow, replacing Exxon-Mobil, Pfizer, and Raytheon Technologies.

2020 Companies in the Dow

Below is a list of the companies included in the Dow as of September 2020.

Salesforce

Procter & Gamble

DowDuPont

Amgen

3M

IBM

Merck

American Express

McDonald’s

Boeing

Coca-Cola

Caterpillar

JPMorgan Chase

Walt Disney

Johnson & Johnson

Walmart

Home Depot

Intel

Microsoft

Honeywell

Verizon

Chevron

Cisco Systems

Travelers Cos.

UnitedHealth Group

Goldman Sachs

Nike

Visa

Apple

Walgreens Boots Alliance

More about the DOW click here.

I hope the above information was of interest to you.

Anthony at TradeCurrencyNow,

America’s Forex News and Currency Information Source.

The above information is opinion based except where noted. This web page and website information is NOT trading advice. Always contact a licensed professional for information on the above subject or BEFORE applying or practicing the above information.