The Santa Claus Rally historically usually delivers strong market returns during such a short time frame (from 12-22-23 and ends on the second trading day of January):

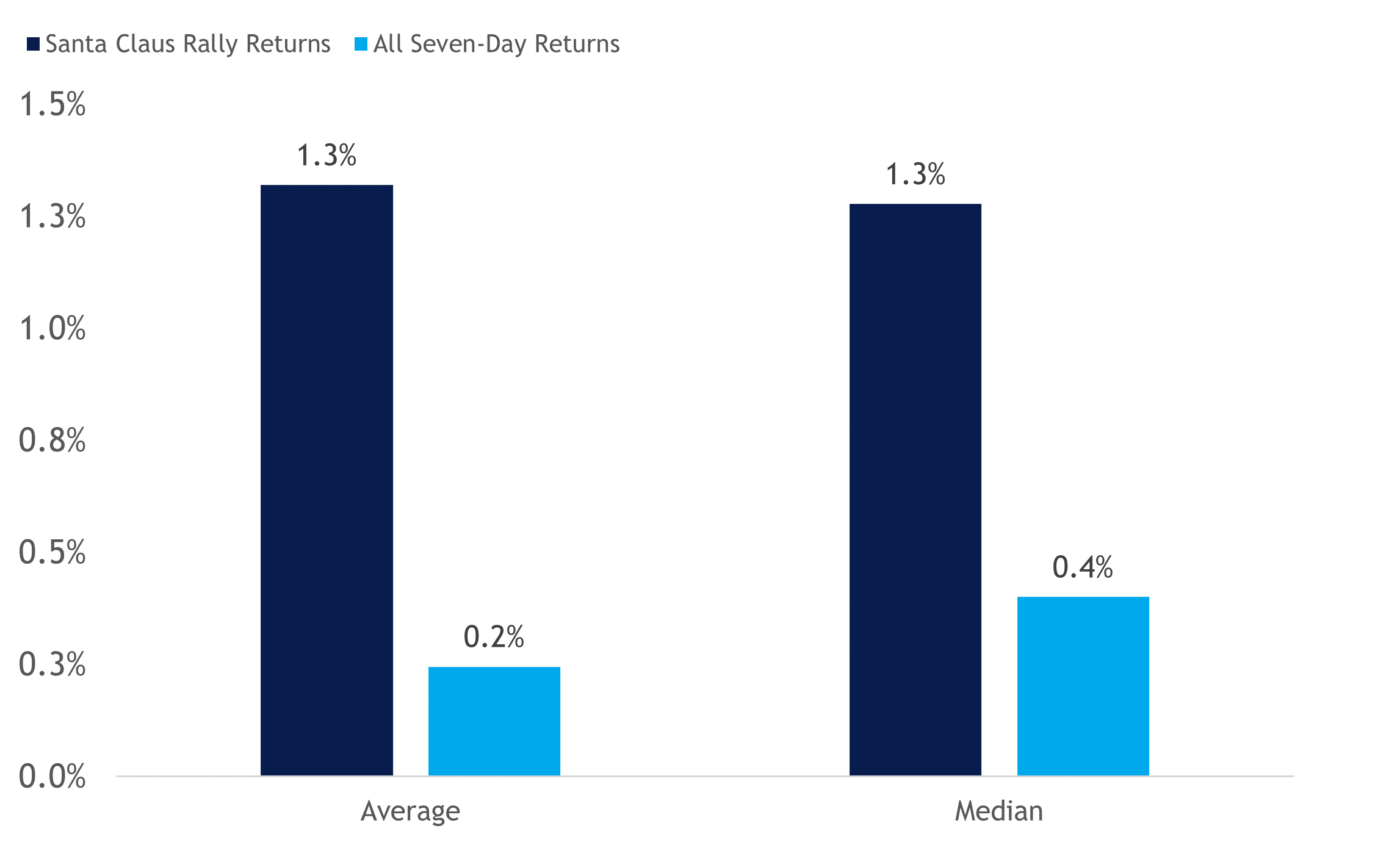

As highlighted in the chart below, the S&P 500 has generated average and median returns of 1.3% during the Santa Claus Rally period, compared to only 0.2% and 0.4% average and median returns for all rolling seven-day returns, respectively.

Please refer to the below Santa Clause Rally History bar chart as sourced at LPL Research, Bloomberg 12/22/23.

The Santa Claus Rally Historically Delivers Above-Average Gains

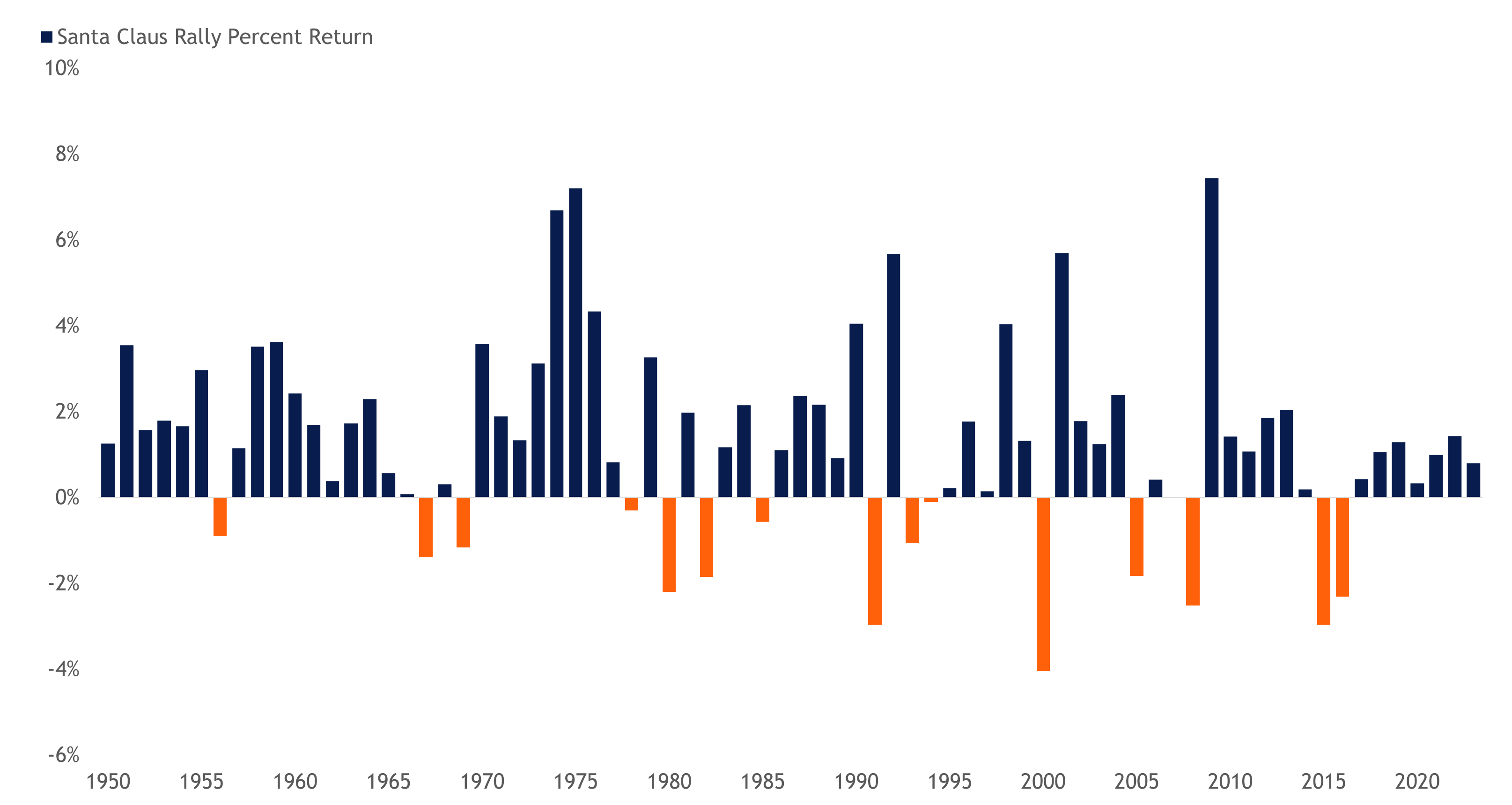

When the S&P 500 finishes higher during this year’s Santa Claus Rally, it will mark the eighth consecutive period of positive returns. The longest streak was 10 back in the mid-1960s. However, as highlighted in the table below, positive returns during the Santa Claus Rally are relatively common, as the market has advanced 80% of the time during this period. All rolling seven-day returns for the S&P 500 since 1950 have a positivity rate of only 58%.

Please refer to the below Santa Clause Rally Chart as sourced at LPL Research, Bloomberg 12/22/23.

S&P 500 Santa Claus Rally Returns by Year from 1950 through to 2022

How Stocks Perform With or Without Santa Showing Up

For more on the above chart and this Santa Clause Rally Theory by LPL Financial click here.

To view another theory on the Santa Clause Rally at Trade Currency Now Forex Blog click here.

NOTES ON WHY PAST HISTORY MAY NOT BE A TRUE INDICATOR FOR TODAY’s MARKET: Keep in mind that we are in some unusual financial times with government overreach/market manipulation, hyper inflation, high spending through FED monetary easing and 2024 is a presidential election year on the opposite side we have high debt, highly leveraged markets, wars and attacks and the next pandemic that can crash a market.

I hope the above information was of interest to you.

Anthony at TradeCurrencyNow,

America’s Forex News and Currency Information Source.

The above information is opinion based except where noted. This web page and website information is NOT trading advice. Always contact a licensed professional for information on the above subject or BEFORE applying or practicing the above information.